Compliance continues to be one of the most challenging and critical areas for businesses to navigate. In 2024, we saw significant shifts in regulatory landscapes, the rise of emerging technologies, and the evolution of business needs. It has become clearer than ever that, to stay compliant, financial institutions must not only adapt but stay ahead of the curve.

As a leading provider of compliance recording solutions, we understand the critical elements in navigating the increasing complexity of regulations. Below, we share three key measures which made compliance more manageable for financial institutions in 2024, enabling a strong foundation for successful compliance in 2025. You'll also get to benefit from a 50% discount offer.

Measure #1: Gain Access to Expertise

Partnering with experts in compliance is no longer just an option—it’s a necessity. By collaborating with specialized providers, financial institutions gain access to a comprehensive set of tools, which become increasingly important as financial regulations grow more intricate.

In 2024, we’ve entered into partnerships with several key players to enhance our recording solution and our customers’ experience, amongst them:

- ComitFS, who support us with proactive recording assurance, which is crucial for safeguarding against possible omissions in recording.

- SteelEye, a leading provider in communications surveillance tools to actively identify and address market manipulation and compliance violations, and

- Intelligent Voice (Verint), who enable our AI-driven analytics and speech recognition capabilities.

Partnerships can enable businesses to stay on top of the regulations while focusing on what truly matters: delivering excellent service and maintaining customer trust.

Measure #2: Use Intelligent Technology

As 2024 marks the 4th year in a row we’ve won the coveted Verint Financial Compliance Hosting Partner of the Year Award, and were named in the RegTech100 list, we continue to demonstrate our commitment to solving compliance challenges and providing excellent, future-driven financial compliance and compliance recording solutions.

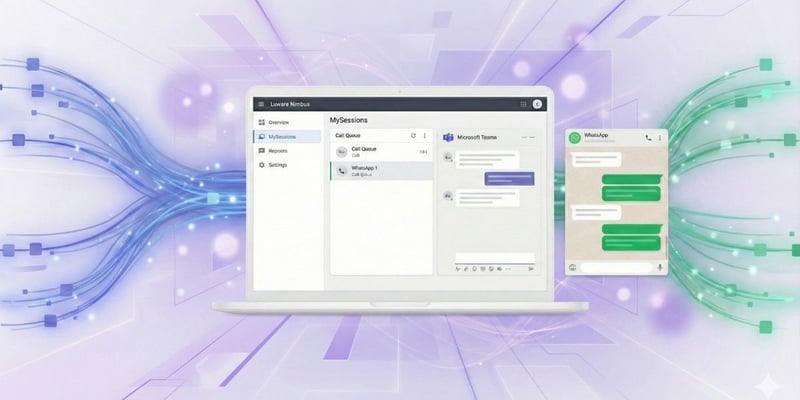

A significant compliance challenge that businesses faced in 2024 was the increasing shift of customer interactions to chatbots, social media, and other non-traditional communication channels. The strategic implementation of an AI-powered omnichannel solution, capable of seamlessly integrating with existing systems, is critical to addressing these evolving demands and ensuring compliance. When applied responsibly, AI empowers financial institutions to:

- Implement Proactive Compliance: Historically, samples of compliance data would be manually processed for review or specific cases would be investigated. Natural language processing (NLP), machine learning (ML) and AI now allow automatic alerting for detection of policy breaches, such as market abuse or insider trading.

- Be More Efficient: The ability to automatically generate reports and monitor communication recordings allows teams to focus on higher-value tasks, such as strategy development and customer engagement. Efficiency gains in compliance monitoring also mean fewer resources are needed to manage compliance processes, allowing companies to scale and maintain compliance across larger operations.

- Get Deeper Insights: AI-powered analytics provide valuable insights into organizational data, enabling businesses to identify patterns, trends, and potential risks before they escalate.

Measure #3: Invest in Certified Solutions

To stay ahead of compliance challenges, it’s essential to invest in software and systems that are not only secure but also enable institutions to meet the latest regulations such as FINMA, MiFID II, Dodd-Frank and data privacy obligations such as GDPR. This ensures that your business is aligned with industry standards, minimizes risk, and demonstrates your commitment to maintaining the highest levels of security and compliance.

Some of the most important certifications for online compliance services are:

- SOC 2 Type II: offers an objective, third-party evaluation of security measures designed to safeguard customer data within cloud environments.

- ISO 27001: establishes global criteria for Information Security Management Systems (ISMS), outlining the necessary security controls to protect sensitive information.

- ISO 9001: sets the global benchmark for Quality Management Systems (QMS), ensuring compliance with both customer and regulatory standards.

Luware Recording achieved M365 certification in 2024, which evidences our solution has met the rigorous standards set out by Microsoft such as our adherence to industry-leading security practices, data protection measures and regulatory compliance requirements. This provides peace of mind to both businesses and regulators, ensuring that the software is rigorously tested to meet legal requirements.

Conclusion: Regulations Are Increasing, and So Is the Need for Smart, Secure Solutions

As we’ve learned in 2024, the regulatory environment for the financial sector is only becoming more complex. Compliance is no longer a task to be managed; it is an ongoing, dynamic process that requires constant attention. The growing need for smart, secure solutions is clear—proactive compliance, AI-powered insights, and certified solutions are now essential for navigating compliance challenges effectively.

If you're committed to making 2025 your compliance year, watch out for our upcoming article in January, where we will dive deeper into the compliance trends and challenges for 2025, including possible solutions.

Until then, don’t miss out on our end-of-year offer where you’ll get 50% off Intelligent Voice Speech Analytics bundles as well as free Intelligent Voice onboarding when ordering Luware Recording Advanced. Claim your 50% discount by entering the code ‘XLOD24’ in the message section when filling out the form below (valid until January 31, 2025).