SIX Boosted Efficiency and Compliance in One Move

Discover how SIX streamlined call management and compliance recording, resulting in greater efficiency, flexibility, and long-term compliance.

The financial services industry faces a dual challenge: meeting rising customer expectations for seamless, personalized experiences while adhering to strict regulatory requirements like MiFID II and FINRA rules. By unifying your customer communication and compliance recording on a single, secure platform, you can protect your firm and provide the exceptional service that builds trust and drives growth.

The financial services industry is characterized by rigorous regulatory oversight and customer demands for instant, highly secure service. Organizations must balance continuous modernization with the need for strict data integrity and compliance.

Luware's solutions directly address your most pressing challenges by transforming how you achieve compliance and serve your clients. Our platform integrates powerful features into a single, unified environment, built for the demands of the financial sector.

Routes calls based on a client's plan, account tier, or directly to their dedicated case handler. This speeds up claims processing and strengthens client relationships by ensuring an expert connection immediately.

Traditional IVR systems force clients through rigid menus, often resulting in transfers or connecting them to an agent without the required specialization. This increases frustration and costs valuable time on the trading floor.

Call audio is fully transcribed, and an AI-driven summary is automatically generated and logged into the CRM/ticketing system. This eliminates manual note-taking, allowing agents to provide their full attention and ensuring complete documentation for every claim.

Agents must split their focus between supporting the client and manually documenting all conversation details into multiple systems. This increases the risk of human error, resulting in incomplete records and a heavy after-call work (ACW) burden.

All communications, including trader voice and internal MSFT Teams chats, are captured and securely retained. This centralized, audit-proof capture across all platforms ensures the firm meets strict mandates like those set by MiFID II and FINRA.

Recording is often inconsistent across new and legacy channels (e.g., softphone vs. mobile). Failure to capture a single client interaction correctly, even due to a system error, risks severe regulatory penalties and fails the audit readiness test.

All digital interactions (e.g., WhatsApp, secure chat, email) are handled within a single Teams interface. Tasks are routed with the same intelligence as voice calls, maximizing agent productivity and consistency across the firm.

Conversation history is split across disparate systems (CRM, legacy telephony, separate chat apps). This forces agents to constantly toggle screens and ask the client to repeat sensitive information.

Adaptive cards are used to offer agents direct follow-up tasks (e.g., "send claims form", "arrange follow-up call") instantly on their screen. This ensures that no time-sensitive action is missed and streamlines complex client claim management.

Follow-up tasks are manually tracked, relying on memory or disparate checklists. This leads to missed deadlines and creates workflow gaps, negatively impacting client trust and increasing potential operational risk.

Get a tailored walkthrough of how our CX solution integrates seamlessly and securely with your existing core banking or financial technology. Learn how to streamline service delivery, improve efficiency, and maintain regulatory compliance.

Adhering to strict regulations and ensuring an excellent customer experience are crucial for your success. Our solutions deliver measurable results by transforming the complexity of financial communication into efficient workflows.

Utilize AI-driven transcription and summarization to automatically log customer conversations and transfer relevant details to the CRM. This ensures full audit documentation and allows advisors to focus entirely on the client.

Route calls from major or important clients (VIPs) based on their account tier or plan directly to their dedicated case handler or agents with the highest qualifications. This significantly accelerates service and strengthens high-value client retention.

Detect potential compliance breaches automatically via AI-powered alerts, and ensure that every communication, including trader voice calls and mobile interactions, is automatically captured and securely archived. This is essential for meeting the zero-tolerance requirements of MiFID II and FINRA.

Guide clients using natural language understanding (NLU) through the process of ticket or application creation. This streamlines back-office processes, reduces form errors, and shortens the time-to-service.

Integrate all communication channels (phone, WhatsApp, chat) into the familiar Microsoft Teams environment. This allows for the instant routing of digital inquiries to the best-suited advisor and provides unified reporting across all touchpoints.

The financial world demands trust and proven reliability. Our compliance recording and intelligent routing solutions are deployed globally to help banks and insurers reduce risk, enhance client service, and maximize efficiency.

Daniel Steinmann

Responsible for Realtime Communication Services

Christoph Ruys

Product Owner

Ralf Luchsinger

Head of ICT

Marc Vandersmissen

ICT-Manager at FOD Financië

Discover how SIX streamlined call management and compliance recording, resulting in greater efficiency, flexibility, and long-term compliance.

Guarantee of quality and security.

Adhering to strict regulations and ensuring complete documentation is not optional for financial institutions; it’s an existential necessity. The following data clarifies why investing in a modern communication solution is mandatory.

Luware consolidates your GRC investments by offering a single, audit-proof solution for compliance recording across multiple platforms. This simplifies the IT landscape and reduces system maintenance complexity.

Source: MarketsandMarkets: "Governance, Risk, and Compliance Platform Market - Global Forecast to 2028"

Our solutions ensure that all trader voice calls and digital interactions are automatically captured. This guarantees audit readiness and proactively protects your firm against severe financial consequences.

Source: FCA Handbook (SYSC 10A) UK

Through intelligent routing and omnichannel capabilities (e.g., WhatsApp), clients are immediately connected with the right expert. This meets the demand for fast, digital service and strengthens customer loyalty.

Source: McKinsey & Company / Accenture: Digital Banking Consumer Survey

Our solutions automatically capture all regulated communications, including trader voice calls and digital interactions, across multiple devices. This centralized recording support your firm in meeting the strict zero-tolerance mandates of MiFID II and FINRA.

Yes, our platform is natively built for Microsoft Teams, ensuring seamless integration with your existing telephony environment. We use tools like Power Automate to integrate with your CRM for screen pops and automatic activity logging.

We use intelligent routing to identify high-value clients (VIPs) via CRM lookup and route them directly to their dedicated case handler or an agent with the highest skill level. This drastically reduces wait times and strengthens client loyalty.

All recorded conversations are archived in a secure, audit-proof format and stored for the legally required period. The system provides powerful search and reporting features, allowing you to instantly retrieve any conversation for an audit.

Yes, our solution offers multichannel functionality, allowing agents to manage voice calls and digital messaging (e.g., WhatsApp) from a single interface within Microsoft Teams.

Our AI-powered platform automatically transcribes and summarizes call content, logging it directly into your ticketing system or CRM. This eliminates manual note-taking and drastically reduces human error during post-call documentation.

Connect with one of our CX specialists to discuss your financial institution's challenges, such as digital transformation, fraud prevention, or enhancing relationship management.

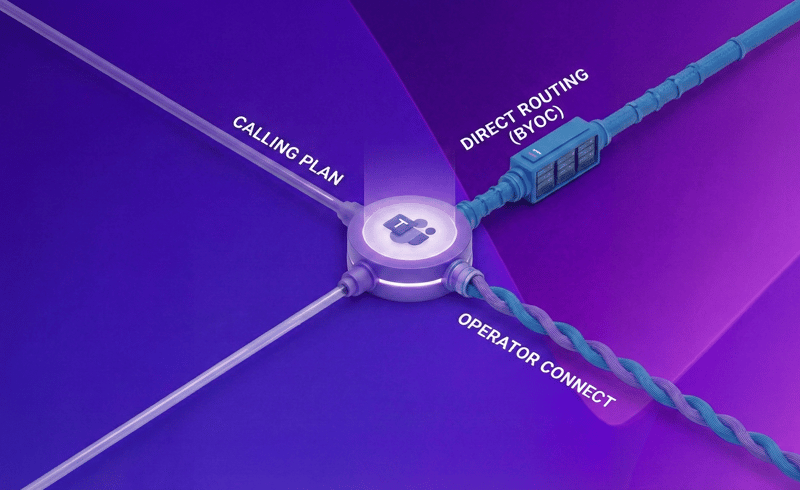

Compare Microsoft Calling Plans, Direct Routing, and Operator Connect to determine the best telephony solution for your business needs. Explore cost, coverage, and technical requirements for optimal d...

Discover the 2025 compliance takeaways that matter most, and what strategic shifts financial services firms must make in 2026 to stay ahead of the curve.