How does Luware Nimbus help with compliance and audit trails?

Every call is fully transcribed and summarized, with the full interaction trail (details, summary, patient tier) securely logged in the crm for governance and audit purposes.

In a competitive insurance market, retaining policyholders and processing claims quickly are critical differentiators. Luware Nimbus transforms customer and agent experiences by unifying complex systems and intelligently routing high-value interactions natively within Microsoft Teams.

The insurance industry faces unique pressure to balance regulatory compliance and risk management with the demand for faster, more personalized policyholder service.

The current landscape of policyholder communication often leads to frustrating delays and inefficient agent workflows. This comparison illustrates how Luware Nimbus, built on Microsoft Teams, fundamentally changes that dynamic compared to traditional contact center solutions.

Calls are routed based on specific criteria like insurance plan, account size, or geolocation to the agent with the highest skill level on that topic.

Customers must navigate long, confusing phone menus and often end up with the wrong department, forcing multiple transfers.

Every call is transcribed and summarized using AI, with the data automatically populated into the CRM or ticketing system.

Agents spend significant time taking notes during sensitive calls, which distracts them from the customer and risks incomplete documentation for compliance.

Large clients or high-value policyholders are automatically routed to their dedicated case handler or account manager, strengthening relationships.

Customers are connected to the next available agent, often leading to a lack of continuity and requiring them to repeat their information.

All communication channels (voice, WhatsApp, live chat, SMS) are handled via one interface natively in Microsoft Teams, improving agent productivity and reducing effort.

Agents must switch between different systems for calls, chat, and email, slowing down resolution and making comprehensive reporting difficult.

Interaction history is automatically popped on the agent's screen, and adaptive cards offer follow-up tasks like sending claim forms, ensuring no action is missed.

Agents must manually search the CRM when a call connects, and critical follow-up actions are reliant on agent memory or manual ticketing systems.

Connect with one of our insurance specialists to discuss your challenges and discover how our solutions can help you achieve your goals.

Insurance is built on trust, and operational efficiency is the foundation of that trust. Our customers leverage Luware Nimbus to standardize service, accelerate claims processing, and strengthen policyholder relationships, leading to measurable improvements in efficiency and customer satisfaction. The following example demonstrates how leading insurers achieve consistent, high-quality service across complex organizations.

Sonja Rupf

Generali Switzerland

Luware Nimbus helps insurance providers modernize their communication workflows by connecting AI, external systems, and human agents to handle policyholder queries faster, from initial contact to claim closure.

The Luware Nimbus Virtual User gathers initial claim details using AI/Text-to-speech, increasing the accuracy of call routing from 75% to 96% and significantly reducing customer wait time.

All calls are fully transcribed and summarized using copilot studio, and automatically logged in the CRM/Ticketing System, ensuring full agent focus is on the customer and not documentation.

The system offers omnichannel functionality, routing tasks like WhatsApp, SMS, live chat, and emails with the same intelligence as voice calls, all within a single Microsoft Teams interface.

Luware can be used to offer agents follow-up tasks (e.g., send claims form or arrange a follow-up call) to ensure necessary actions related to the claim are not missed.

Calls can be routed based on parameters like account size or insurance plan, ensuring high-value or complex claims are immediately directed to the most skilled agents.

For insurance providers, maintaining strict compliance is non-negotiable. Luware Nimbus is built on Microsoft Teams, leveraging the platform's security and integrating transcription and audit trails to support global regulatory requirements, from Solvency II to regional data protection laws.

How Luware can help: By implementing Intelligent Call Routing and AI-powered Transcription/Summarization, Luware Nimbus helps insurers process claims faster. Agents get contextual screen pops upon answering, reducing time spent on documentation and accelerating the time to first action.

Source: Accenture

How Luware can help: The Luware Virtual User handles initial, fact-based inquiries—such as claim or payment status checks—autonomously. This immediately reduces call volume during busy periods, freeing up specialized human agents for complex and urgent cases.

Source: Computer Science & IT Research Journal (2024), Coinlaw.io

How Luware can help: Skill-Based and Preferred Agent Routing ensure customers with complex issues (e.g., high-value claims or specific insurance plans) are routed to the most qualified agent with their full history instantly available. This focus on FCR drives loyalty, as 62% of claimants with a good experience remain customers.

Source: SQM Group

Every call is fully transcribed and summarized, with the full interaction trail (details, summary, patient tier) securely logged in the crm for governance and audit purposes.

Yes, Luware uses Power Automate to integrate with a wide range of external systems, allowing agents to instantly see open orders or returns, and screen-pop new order or returns forms upon call connection.

The voice bot can detect urgency based on the caller's language and automatically set a high distribution priority directly in the Nimbus workflow, ensuring faster connection to a crisis response team.

Since all calls are automatically transcribed and summarized and auto-logged in the CRM, agents are free to provide the customer with their full attention, improving the customer experience.

Yes, parameter-based routing can route calls based on the insurance plan the customer is on, ensuring they are connected to agents with the highest skill level on that specific plan.

Based on your specific needs, we will tailor a walkthrough of the features that will help you the most.

AI compliance recording: values, risks, and how to build a foundation that holds. Read the honest guide for regulated firms.

Discover how modern AI chatbots revolutionize customer service, drive revenue, and streamline operations through strategic implementation and high-value applications.

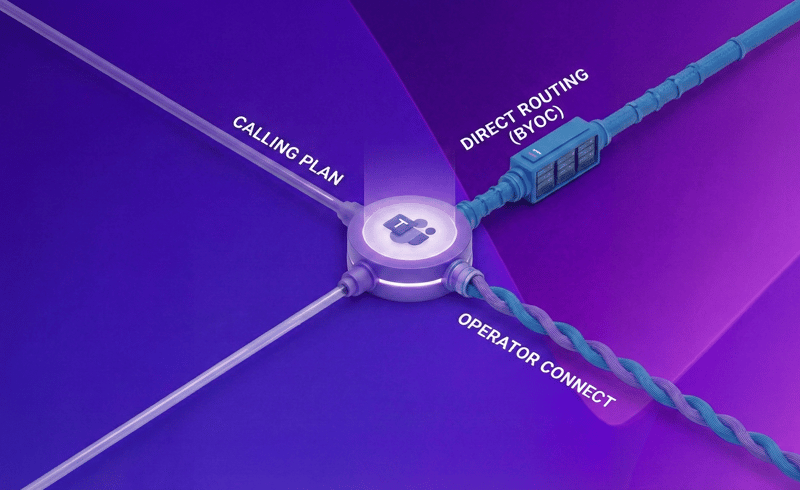

Compare Microsoft Calling Plans, Direct Routing, and Operator Connect to determine the best telephony solution for your business needs. Explore cost, coverage, and technical requirements for optimal d...