Financial institutions are navigating a rapidly evolving compliance landscape shaped by stricter regulations, advancements in artificial intelligence (AI), and new technological possibilities. The year 2025 represents a significant period where institutions must adopt innovative strategies to address these challenges and opportunities effectively.

In the following article, we’ll explore the key compliance trends and innovations shaping the industry in 2025, providing insights into how institutions can stay ahead in this dynamic environment.

Stricter and evolving regulations

European regulatory frameworks, such as the EU AI Act and the Digital Operational Resilience Act (DORA), are setting new benchmarks for compliance. The EU AI Act introduces specific guidelines for deploying AI systems, particularly those classified as high-risk, ensuring transparency, accountability, and human oversight. Meanwhile, DORA focuses on enhancing operational resilience for financial services, emphasizing robust data management and cybersecurity measures.

How to address it: These evolving regulations require financial institutions to implement comprehensive data capture and archiving mechanisms to meet requirements for transparency and auditability. The emphasis is now on demonstrating a proactive, risk-based approach to managing operational and systemic risks.

Disruption of surveillance automation by AI

AI is transforming surveillance by enabling financial institutions to monitor communication channels with greater accuracy and efficiency. Behavioral analytics powered by machine learning can automatically detect patterns indicative of market abuse, insider trading, or other misconduct.

As AI adoption accelerates, regulatory frameworks are likely to evolve to address its implications. Questions around algorithmic accountability, bias, and explainability are driving institutions to reassess their AI governance structures.

How to address it: This shift is also creating new positions in companies, such as AI Governance Lead, Compliance Data Scientist, and AI Auditor, tasked with ensuring AI systems are transparent, compliant, and fair. These roles bridge the gap between technological innovation and regulatory requirements, ensuring that AI aligns with organizational goals and ethical standards. Compliance leaders must ensure these systems remain auditable and aligned with regulatory expectations.

Ethical challenges: privacy vs. surveillance

In Europe, the General Data Protection Regulation (GDPR) enshrines the right to privacy, creating inherent tensions with surveillance regulations. Monitoring employees’ communications for compliance must be carefully balanced with protecting their privacy.

How to address it: The challenge lies in achieving compliance without overstepping privacy boundaries. Transparency, consent, and minimizing data collection are critical. Organizations must clearly communicate the purpose and scope of surveillance while investing in technologies that anonymize or pseudonymize sensitive data to ensure compliance with GDPR.

Revolution of compliance by intelligent technology

Intelligent technology is revolutionizing compliance processes, particularly through automation and predictive analytics. Natural language processing (NLP) tools can analyze vast amounts of text—emails, chat logs, and social media posts—to identify potential violations. Predictive models can highlight emerging risks, enabling proactive action.

How to address it: Over the next few years, unified compliance platforms are expected to gain traction. These platforms integrate data capture, archiving, and surveillance capabilities into a cohesive system. By automating repetitive tasks, they allow compliance teams to focus on strategic priorities.

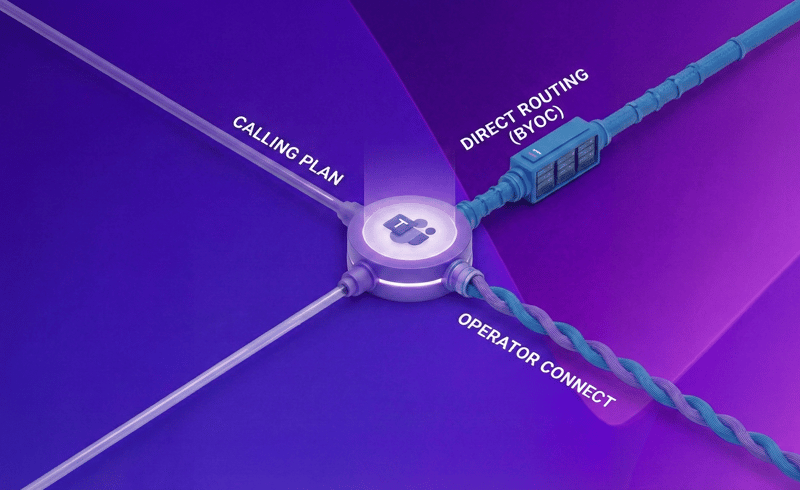

Interoperability as the backbone of AI-powered compliance

Interoperability with cloud-based systems is set to be a cornerstone of compliance innovation. Cloud solutions offer the scalability and flexibility needed to manage growing data volumes and evolving regulatory requirements. Integrating these systems with business applications enables compliance data to enhance business workflows across platforms.

How to address it: For AI to achieve its full potential, interoperability between compliance tools and core business systems is essential. This integration enables holistic oversight, allowing AI to draw insights from multiple data sources and provide actionable intelligence. Institutions that prioritize interoperability will enhance their compliance capabilities and improve operational efficiency.

An AI-powered solution to tackle compliance challenges

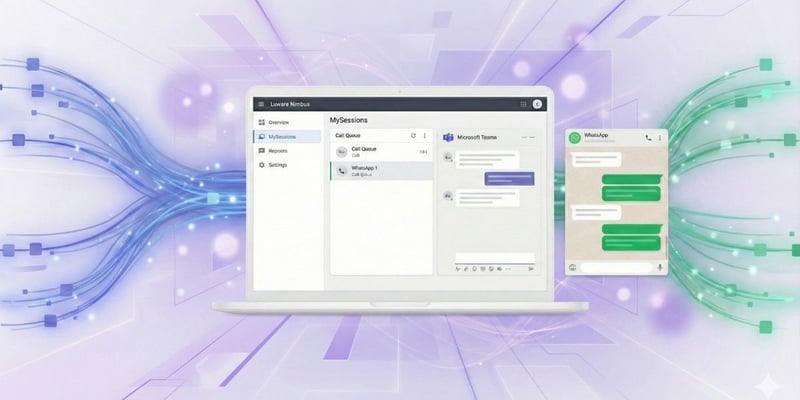

Luware Recording, a state-of-the-art compliance recording solution powered by AI analytics, effectively addresses the key challenges faced by financial institutions:

- Streamlined regulatory compliance: Luware Recording enables adherence to regulations like MiFID II and Dodd-Frank by securely monitoring communications across multiple channels, supported by robust archiving features and industry-leading security standards such as SOC 2 Type II.

- Proactive risk management: Luware Recording integrates with SteelEye, a leading provider of surveillance, to enable the detection of patterns indicative of market abuse or insider trading, empowering institutions to identify and mitigate potential risks before they escalate.

- Seamless integration for enhanced efficiency: Designed to integrate deeply with existing business systems and workflows, Luware Recording ensures smooth interoperability, improving overall transparency and operational efficiency.

By centralizing recording, archiving, and analytics within a single platform, Luware Recording simplifies compliance workflows, providing institutions with the tools they need to maintain transparency, accountability, and efficiency in a rapidly changing landscape.

Conclusion

The compliance landscape is undergoing a significant transformation, driven by stricter regulations, innovative technologies, and ethical imperatives. Financial institutions must adopt intelligent, interoperable solutions to effectively navigate this complex environment. By striking a balance between innovation and regulatory adherence, the financial sector can build resilient compliance frameworks that foster trust and accountability.

Discover Luware Recording